We are 9fin

The AI-native intelligence platform for modern credit teams.

A brief history

Behind every loan, bond, or restructuring is a team making high-stakes decisions — navigating information that's never been more complex or more critical.

We built 9fin to cut through that complexity. By unifying hard-to-access data, expert insight, and AI in a single platform, we help credit teams save time, win business, and outperform their competition.

That focus has guided everything we’ve built since day one.

Why are billion-dollar decisions made with 1980s technology?

Earlier in their careers, 9fin's co-founders Steven and Huss worked inside the world's largest investment banks, watching teams plan and execute billion-dollar credit deals using tools built decades ago. Spreadsheets, PDFs, even fax machines.

The credit industry’s infrastructure was decades out of date.

So in 2016, Steven and Huss quit their jobs to build 9fin.

Why are billion-dollar decisions made with 1980s technology?

Earlier in their careers, 9fin's co-founders Steven and Huss worked inside the world's largest investment banks, watching teams plan and execute billion-dollar credit deals using tools built decades ago. Spreadsheets, PDFs, even fax machines.

The credit industry’s infrastructure was decades out of date.

So in 2016, Steven and Huss quit their jobs to build 9fin.

AI-powered data extraction at scale

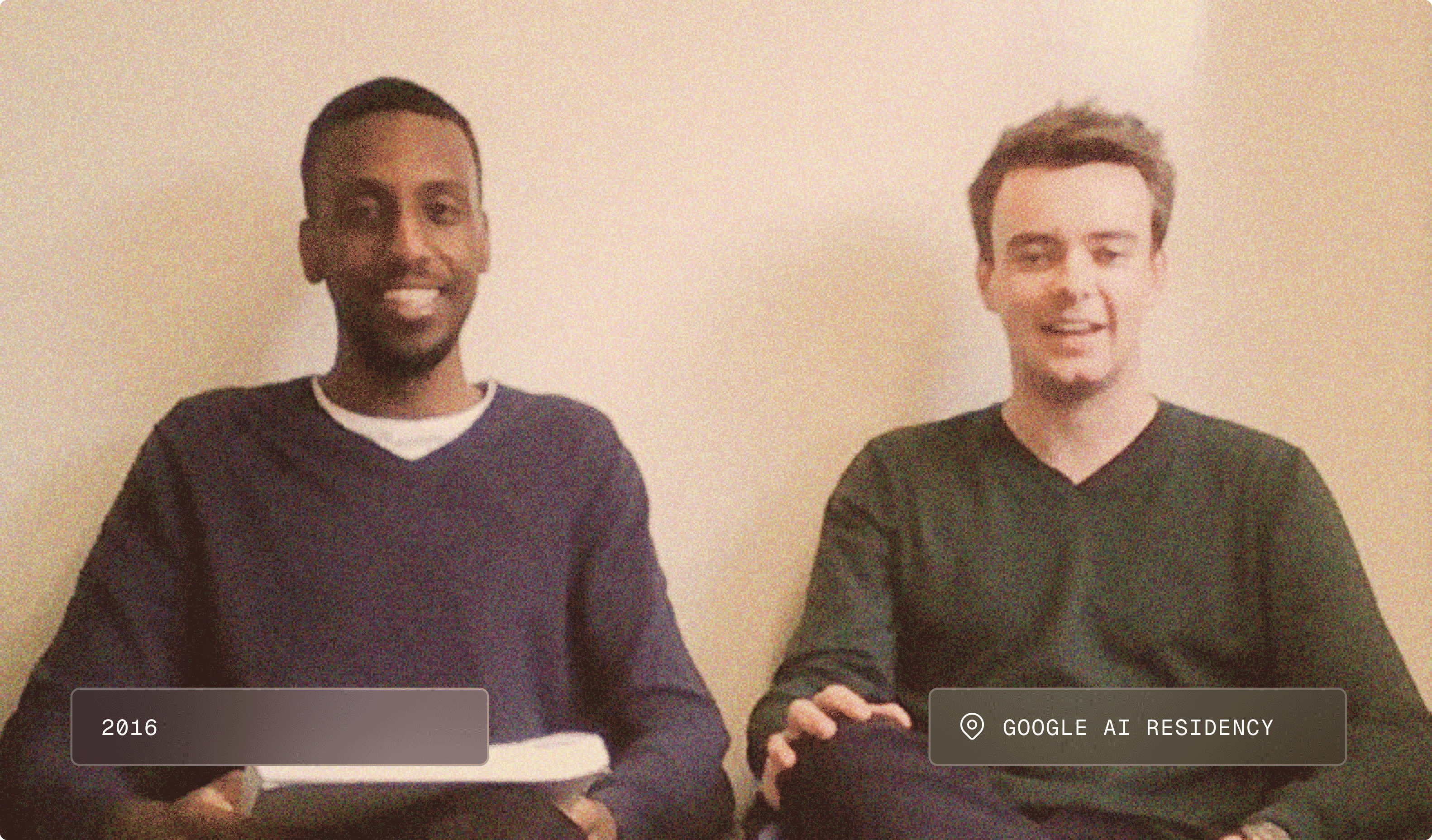

When they applied to Google's AI residency in 2016, they summed up their idea in three words: "AI-powered financial data."

Their thesis was that credit's biggest bottleneck wasn't lack of information — it was that no one could process it at scale.

So they engineered technology that could read these complex documents automatically, extracting terms like covenants and pricing — and mapping the relationships between them — at speed.

Building the first AI platform for credit

For nearly a decade, 9fin has been solving the hardest problems that make AI reliable for debt markets: turning complex and messy financial data into structured, decision-ready insights. Guardrails and human oversight keep the outputs safe and trustworthy.

By combining our technology with expert reporters, credit analysts, and legal specialists who validate every output, we deliver intelligence that's not just fast, but accurate, connected, and dependable.

By the numbers

9fin today

Today, 9fin powers credit teams at 300+ of the world's leading institutions — investment banks, asset managers, hedge funds, law firms, advisors, and private credit funds.

We deliver comprehensive coverage across leveraged finance, distressed debt, CLOs, private credit, ABF, and investment grade, covering North America, Europe, Latin America, and the Asia-Pacific region.

Our platform combines breaking news from expert reporters, structured data and analytics, and AI-powered workflows that can do weeks of research in minutes.

We’re building toward a single goal: becoming the #1 global provider of AI, data, and analytics for the debt capital markets — this decade!

Who’s betting on us to get there